Students are no strangers to money being tight, and right now we’re heading for an

unprecedented period of financial woes. Prices are at an all-time high, leaving many of us

anxious about making ends meet. Having made the jump from generous undergraduate

maintenance loans to barebones postgraduate funding, I’ve learnt to make savings

wherever I can. Small changes can add up to big results, and with just a few tweaks to your

lifestyle you can reap big rewards.

Take control of your finances: A minor inconvenience in the short term could result in long

term savings. Ditch the meal deals for packed lunches and get your steps in instead of

getting an uber. Ask yourself, should I be paying for multiple subscription services or a gym

membership? These things can stealthily drain your bank and, while cutting back won’t

result in the house sized savings that anti-avocado toast columnists might claim, it’ll leave

you in a better position at the end of the month. All this can be the foundation for better

budgeting practices. If you can, aim for the 50/20/30 method, saving 50% for necessities,

20% for savings and 30% for discretionary items!

Conserve your energy: Once upon a time you might have complained your parents told you

to put a jumper on instead of cranking the heating or scolded you for leaving a light on. But

with energy bills forming the bulk of price increases, these habits are more necessary than

ever. Each item might only cost a few quid extra to leave on, but that can quickly rise to

hundreds of pounds in a house full of appliances! And especially with Spring rapidly

approaching, there’s no better time to cut back on the heating bill. Reducing your energy

usage saves money and saves the planet, so it’s well worth the effort.

Go bargain hunting: Looking for the cheapest deal is ancient student wisdom, and for good

reason. It can be easy to prioritise convenience over cost, but it causes bigger issues in the

long run. Make sure you’re using and abusing student discounts, rinsing any free samples

you come across and whipping out the loyalty cards wherever you shop.

Get a side hustle: Realistically, there’s only so far you can cut back before you start hitting

essentials; eventually you just need to up your income. Getting a job is the obvious advice

here, after all in a busy city like Cardiff there’s always plenty of work going in retail and

hospitality. If uni is too busy to commit to regular shifts, agency work and casual shifts like

those offered by the SU Jobshop can be a lifesaver. Finally, online surveys and research are

relatively easy to do, and can add up to a decent amount of spending money. Ultimately,

any additional source of income is a huge help, so check what’s available to you!

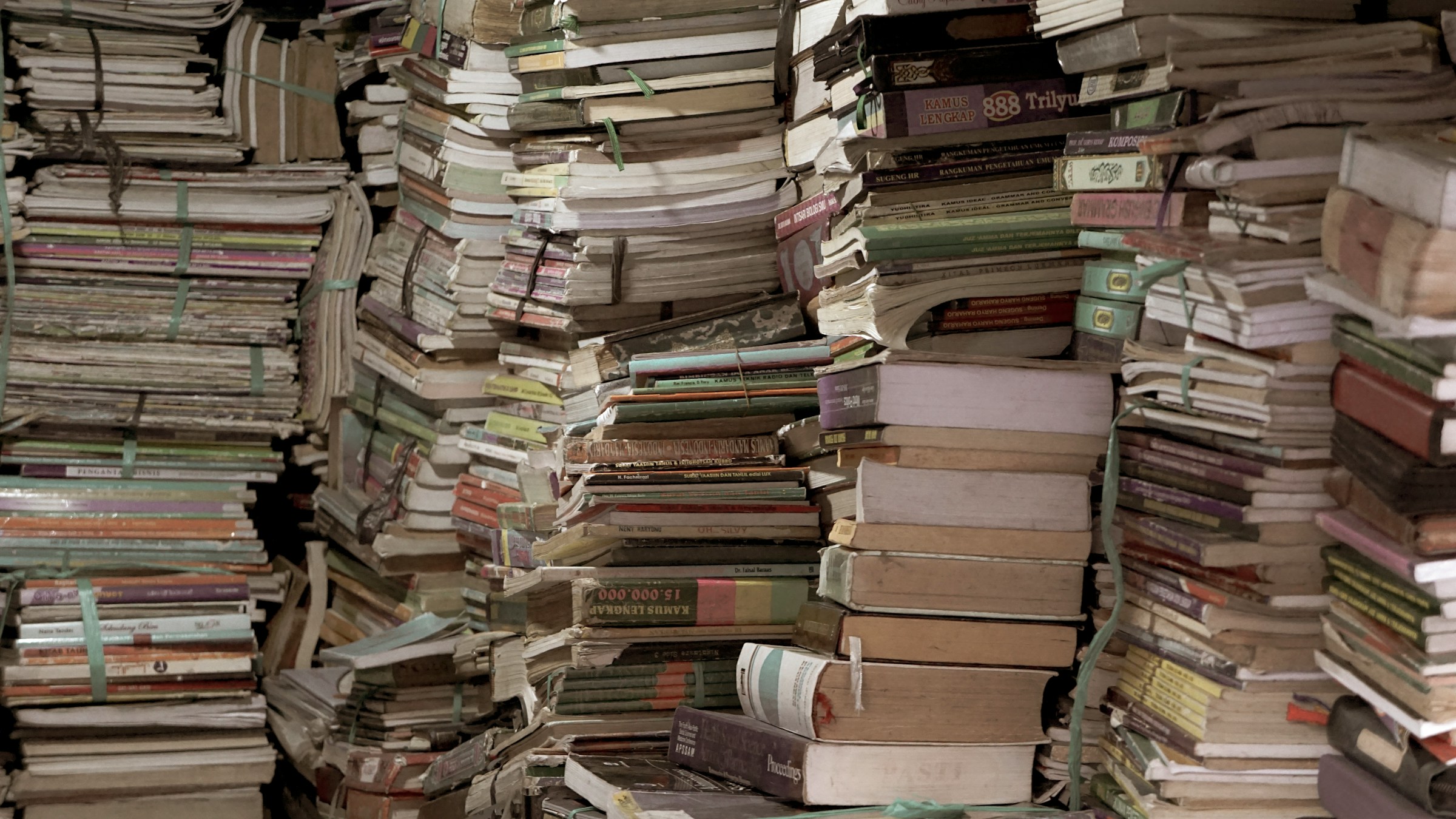

Have a clear out: Maybe you’re too busy, one of the mythical few that does all the reading.

For you, a spring clean could be more profitable than you realise; after all, one man’s trash

is another man’s treasure. Old clothes and tech can fetch a better price than you might

expect, and there’s no better feeling than getting rid of unwanted clutter.

Don’t be afraid to seek help. Even with the most extreme cost-cutting, sometimes your

money simply won’t stretch. Student Advice at the SU can point you in the right direction for

financial assistance, and many utilities providers often temporary freezes or alternative

payment plans. You’ll never know what help is available until you ask, so it never hurts to

try.

Words by Aidan Mc Namee